India’s Journey in Electronics Manufacturing

Mobile Phone Production and Exports Leading the Growth Story

Indian economy has witnessed remarkable growth, surging from a GDP of USD 1 trillion to USD 3.6 trillion, in just over a decade. The electronics industry has been a key driver of this expansion, with mobile phone exports playing a pivotal role.

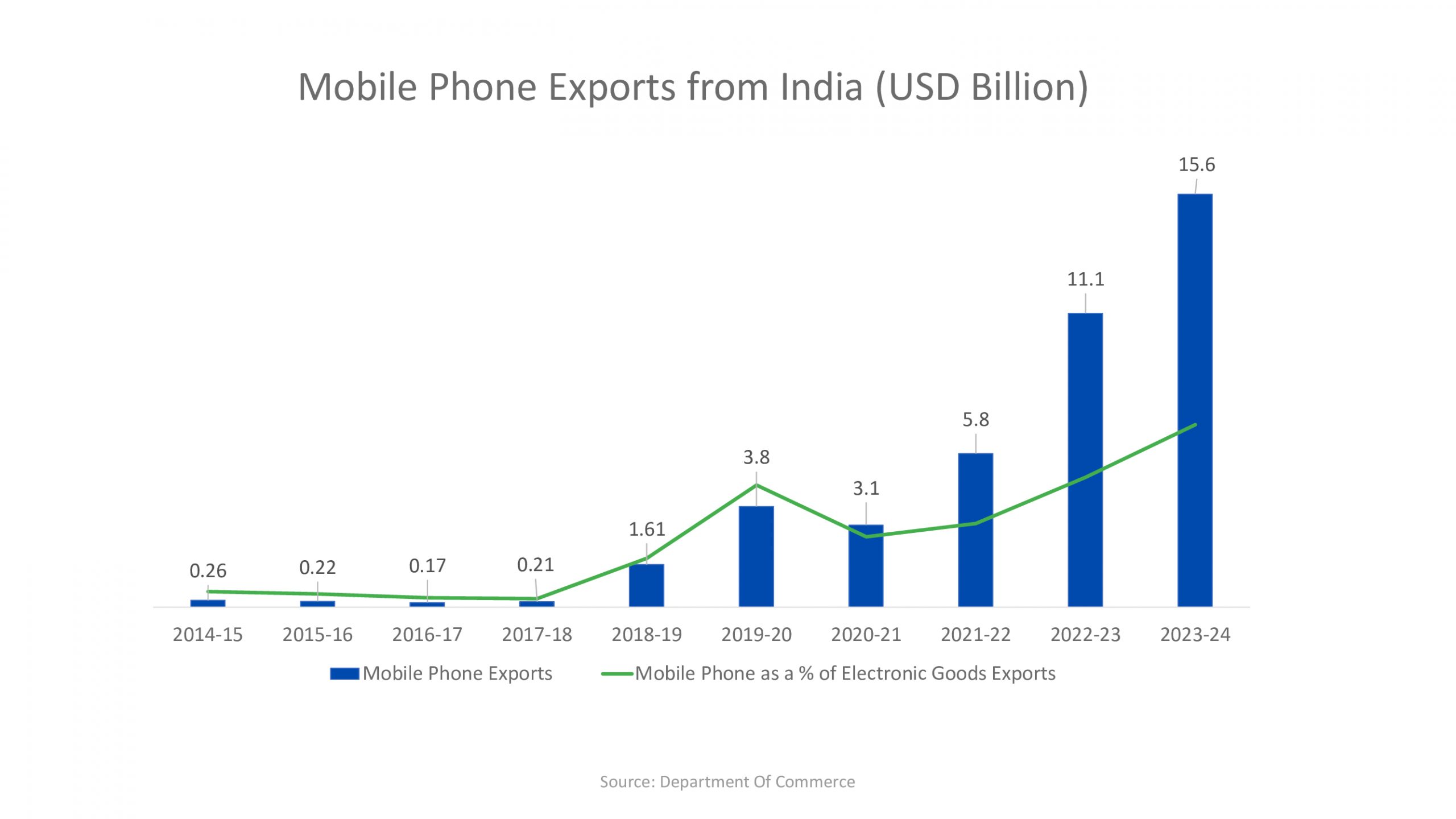

Mobile exports have grown by more than 60x between 2014-15 and 2023-24 and accounted for 54% of total electronic goods exports, reaching USD 15.6 billion in FY 23-24.

The government’s strategic initiatives have propelled the domestic electronics manufacturing ecosystem. Policies like PMP and PLI have attracted foreign investors to set up manufacturing units in India, leading to a surge in mobile and component manufacturing units, from only two a few years ago to now more than 250.

India’s electronics industry has made impressive strides, transitioning from importing 78% of mobile phones in 2014 to less than 3% in 2023-24, securing its position as the world’s second-largest mobile manufacturer. The government’s focus on moving up the value chain has spurred the establishment of domestic semiconductor units, further augmenting the electronics sector’s growth. The focus on deepening the component and sub-assemblies ecosystem will significantly enhance DVA in the coming years.

India Cellular and Electronics Association (ICEA) has played a crucial role in advocating for the industry’s needs and fostering its development. The electronics industry’s future appears promising, and its significance on the global stage cannot be overlooked.

India targets to reach USD 500 Bn by 2030 and increase electronics share in manufacturing from 3% currently to 11-13% by 2030.

The Way Forward

Our objective is to replicate the mobile phone success in other ESDM verticals

There has been a significant increase in both total electronics exports and mobile phone exports over the years, with mobile phone exports occupying an increasingly larger share of the entire electronics exports.

This trend highlights the growing importance of mobile phones in India’s electronics export market. It can be attributed to factors such as expanding domestic production capabilities, government incentives like the PLI scheme and PMP, and a favourable market environment for manufacturers facilitated by the collaborative efforts of ICEA and the government’s receptiveness to reforms.

The success story of mobile phones in India’s export market provides valuable insights that can be applied to replicate growth in other ESDM verticals such as Consumer Electronics, IT Hardware, Wearables and hearables, components and sub-assemblies, strategic electronics, industry electronics etc.

ICEA taking a leading role by engaging in constructive dialogues with the stakeholders intends to leverage its expertise and industry knowledge to identify growth opportunities to create a conducive environment for growth of the sector.

ICEA’s collaborative effort ensures that policies and regulations align with the industry needs promoting competitiveness which sets India on the path of USD 500 Billion in electronics manufacturing by 2030, eventually increasing the electronics sector’s global market share.